9 minutes

Investing with Python: Part 2 - Stocks

This is a continuation of the previous post. Here I will apply the Black Litterman model to a portfolio of stocks.

import pandas as pd

import yfinance as yf

import openpyxl

from currency_converter import CurrencyConverter

import numpy as np

from pypfopt import BlackLittermanModel

from pypfopt import black_litterman, risk_models

# Declare constants

PORTFOLIO='/mnt/wd-bigfoot/share/luis/OneDrive/Documents/Portfolio/00 portfolio.xlsx'

STOCKS_SHEET='Stocks'

START_DATE='2010-01-01'

END_DATE='2021-01-08'

ALL_WORLD='IWDA.AS'

TOTAL_FUNDS=40e3 # 40.000 EUR

# Open the portfolio and get the stocks

stocks_pd = pd.read_excel(PORTFOLIO, engine='openpyxl', sheet_name=STOCKS_SHEET)

stocks_pd.index = stocks_pd['Symbol']

stocks_pd = stocks_pd[['Company Name', 'Prediction', 'Pesimistic', 'Optimistic']]

stocks_pd

| Company Name | Prediction | Pesimistic | Optimistic | |

|---|---|---|---|---|

| Symbol | ||||

| AMD | Advanced Micro Devices, Inc. | 0.20 | 0.03 | 0.40 |

| AIR.PA | Airbus SE | 0.10 | 0.03 | 0.20 |

| GOOGL | Alphabet Inc. | 0.10 | 0.03 | 0.30 |

| AMZN | Amazon.com, Inc. | 0.20 | 0.05 | 0.50 |

| AAPL | Apple Inc. | 0.15 | 0.00 | 0.40 |

| BA.L | BAE Systems plc | 0.00 | -0.05 | 0.05 |

| CSCO | Cisco Systems, Inc. | 0.00 | -0.05 | 0.05 |

| BN.PA | Danone S.A. | 0.00 | -0.05 | 0.05 |

| FB | Facebook, Inc. | 0.05 | -0.05 | 0.05 |

| GE | General Electric Company | 0.05 | 0.00 | 0.05 |

| HYU.F | Hyundai Corporation | 0.10 | 0.00 | 0.30 |

| IDR.MC | Indra Sistemas, S.A. | 0.00 | -0.05 | 0.02 |

| INTC | Intel Corporation | 0.00 | -0.02 | 0.05 |

| IBM | International Business Machines Corporation | 0.05 | -0.02 | 0.10 |

| IAG.MC | International Consolidated Airlines Group, S.A. | 0.50 | -0.10 | 1.00 |

| PHIA.AS | Koninklijke Philips N.V. | 0.00 | -0.05 | 0.05 |

| MEL.MC | Meliá Hotels International, S.A. | 0.20 | 0.00 | 0.50 |

| MRK | Merck & Co., Inc. | 0.05 | 0.00 | 0.05 |

| MSFT | Microsoft Corporation | 0.10 | 0.00 | 0.15 |

| NESN.SW | Nestlé S.A. | 0.00 | -0.05 | 0.03 |

| NFLX | Netflix, Inc. | 0.05 | -0.01 | 0.15 |

| NHH.MC | NH Hotel Group, S.A. | 0.20 | -0.05 | 0.50 |

| NOKIA.HE | Nokia Corporation | 0.05 | -0.05 | 0.20 |

| NVDA | NVIDIA Corporation | 0.10 | -0.05 | 0.30 |

| ORCL | Oracle Corporation | 0.05 | 0.00 | 0.05 |

| PEP | PepsiCo, Inc. | 0.00 | -0.05 | 0.05 |

| QCOM | QUALCOMM Incorporated | 0.05 | -0.02 | 0.15 |

| SSUN.F | Samsung Electronics Co., Ltd. | 0.10 | -0.02 | 0.20 |

| SIE.DE | Siemens Aktiengesellschaft | 0.05 | -0.02 | 0.10 |

| ENR.DE | Siemens Energy AG | 0.05 | -0.02 | 0.10 |

| SPOT | Spotify Technology S.A. | 0.02 | -0.05 | 0.10 |

| TSLA | Tesla, Inc. | 0.00 | -0.20 | 0.05 |

| TXN | Texas Instruments Incorporated | 0.05 | 0.00 | 0.10 |

| BA | The Boeing Company | 0.05 | -0.05 | 0.10 |

| KHC | The Kraft Heinz Company | 0.00 | -0.05 | 0.05 |

| PG | The Procter & Gamble Company | 0.05 | -0.05 | 0.05 |

| DIS | The Walt Disney Company | 0.05 | -0.05 | 0.20 |

| TMO | Thermo Fisher Scientific Inc. | 0.05 | -0.05 | 0.15 |

| TM | Toyota Motor Corporation | 0.05 | -0.02 | 0.10 |

| UBER | Uber Technologies, Inc. | 0.10 | -0.10 | 0.20 |

| UL | Unilever PLC | 0.00 | -0.05 | 0.05 |

# Get the historical data of the stocks and exchange to EUR

stocks = pd.DataFrame()

cc = CurrencyConverter(fallback_on_missing_rate=True, fallback_on_wrong_date='True')

for symbol in stocks_pd.index:

history = yf.download(symbol, start=START_DATE, end=END_DATE)['Adj Close']

dataframe = pd.DataFrame(history)

currency = yf.Ticker(symbol).info['currency'].upper()

dataframe.columns = [ symbol + ':' + currency ]

# Add Market Cap to the stocks_pd

stocks_pd.at[symbol, 'Market Cap'] = cc.convert(yf.Ticker(symbol).info['marketCap'],

currency, 'EUR',

dataframe.index[-1].to_pydatetime())

# Add column with security in EUR if needed

if currency.lower() != 'eur':

for index in dataframe.index:

original_value = dataframe.at[index, symbol + ':' + currency]

value = cc.convert(original_value, currency, 'EUR', date=index.to_pydatetime())

dataframe.at[index, symbol + ':EUR'] = value

# Merge everything

stocks = pd.concat([ stocks, dataframe], axis='columns')

# Fill any NA values with the best forward or backarwd value

stocks.fillna(method='ffill', inplace=True)

del cc, symbol, history, dataframe, currency, original_value, value, index

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

[*********************100%***********************] 1 of 1 completed

stocks_pd

| Company Name | Prediction | Pesimistic | Optimistic | Market Cap | |

|---|---|---|---|---|---|

| Symbol | |||||

| AMD | Advanced Micro Devices, Inc. | 0.20 | 0.03 | 0.40 | 8.148238e+10 |

| AIR.PA | Airbus SE | 0.10 | 0.03 | 0.20 | 7.461750e+10 |

| GOOGL | Alphabet Inc. | 0.10 | 0.03 | 0.30 | 1.183262e+12 |

| AMZN | Amazon.com, Inc. | 0.20 | 0.05 | 0.50 | 1.355935e+12 |

| AAPL | Apple Inc. | 0.15 | 0.00 | 0.40 | 1.765546e+12 |

| BA.L | BAE Systems plc | 0.00 | -0.05 | 0.05 | 1.787769e+10 |

| CSCO | Cisco Systems, Inc. | 0.00 | -0.05 | 0.05 | 1.811978e+11 |

| BN.PA | Danone S.A. | 0.00 | -0.05 | 0.05 | 3.849391e+10 |

| FB | Facebook, Inc. | 0.05 | -0.05 | 0.05 | 7.102801e+11 |

| GE | General Electric Company | 0.05 | 0.00 | 0.05 | 9.526443e+10 |

| HYU.F | Hyundai Corporation | 0.10 | 0.00 | 0.30 | 3.768063e+10 |

| IDR.MC | Indra Sistemas, S.A. | 0.00 | -0.05 | 0.02 | 1.320735e+09 |

| INTC | Intel Corporation | 0.00 | -0.02 | 0.05 | 2.213519e+11 |

| IBM | International Business Machines Corporation | 0.05 | -0.02 | 0.10 | 1.000500e+11 |

| IAG.MC | International Consolidated Airlines Group, S.A. | 0.50 | -0.10 | 1.00 | 1.080973e+10 |

| PHIA.AS | Koninklijke Philips N.V. | 0.00 | -0.05 | 0.05 | 4.355928e+10 |

| MEL.MC | Meliá Hotels International, S.A. | 0.20 | 0.00 | 0.50 | 1.345669e+09 |

| MRK | Merck & Co., Inc. | 0.05 | 0.00 | 0.05 | 1.683183e+11 |

| MSFT | Microsoft Corporation | 0.10 | 0.00 | 0.15 | 1.537831e+12 |

| NESN.SW | Nestlé S.A. | 0.00 | -0.05 | 0.03 | 2.751414e+11 |

| NFLX | Netflix, Inc. | 0.05 | -0.01 | 0.15 | 2.033889e+11 |

| NHH.MC | NH Hotel Group, S.A. | 0.20 | -0.05 | 0.50 | 1.475451e+09 |

| NOKIA.HE | Nokia Corporation | 0.05 | -0.05 | 0.20 | 1.926819e+10 |

| NVDA | NVIDIA Corporation | 0.10 | -0.05 | 0.30 | 2.806550e+11 |

| ORCL | Oracle Corporation | 0.05 | 0.00 | 0.05 | 1.641228e+11 |

| PEP | PepsiCo, Inc. | 0.00 | -0.05 | 0.05 | 1.651222e+11 |

| QCOM | QUALCOMM Incorporated | 0.05 | -0.02 | 0.15 | 1.291990e+11 |

| SSUN.F | Samsung Electronics Co., Ltd. | 0.10 | -0.02 | 0.20 | 4.059750e+11 |

| SIE.DE | Siemens Aktiengesellschaft | 0.05 | -0.02 | 0.10 | 1.086902e+11 |

| ENR.DE | Siemens Energy AG | 0.05 | -0.02 | 0.10 | 2.160643e+10 |

| SPOT | Spotify Technology S.A. | 0.02 | -0.05 | 0.10 | 4.376889e+10 |

| TSLA | Tesla, Inc. | 0.00 | -0.20 | 0.05 | 5.454659e+11 |

| TXN | Texas Instruments Incorporated | 0.05 | 0.00 | 0.10 | 1.416198e+11 |

| BA | The Boeing Company | 0.05 | -0.05 | 0.10 | 1.208403e+11 |

| KHC | The Kraft Heinz Company | 0.00 | -0.05 | 0.05 | 4.085665e+10 |

| PG | The Procter & Gamble Company | 0.05 | -0.05 | 0.05 | 2.802307e+11 |

| DIS | The Walt Disney Company | 0.05 | -0.05 | 0.20 | 2.940217e+11 |

| TMO | Thermo Fisher Scientific Inc. | 0.05 | -0.05 | 0.15 | 1.527621e+11 |

| TM | Toyota Motor Corporation | 0.05 | -0.02 | 0.10 | 1.805378e+11 |

| UBER | Uber Technologies, Inc. | 0.10 | -0.10 | 0.20 | 8.531728e+10 |

| UL | Unilever PLC | 0.00 | -0.05 | 0.05 | 1.977436e+11 |

# Get market reference (MSCI All World Accumulative ETF in USD)

market = pd.DataFrame(yf.download(ALL_WORLD, start=START_DATE, end=END_DATE)['Adj Close'])

market.columns = ['Market Ref:USD']

cc = CurrencyConverter(fallback_on_missing_rate=True, fallback_on_wrong_date='True')

for index in market.index:

original_value = market.at[index, 'Market Ref:USD']

value = cc.convert(original_value, 'USD', 'EUR', date=index.to_pydatetime())

market.at[index, 'Market Ref:EUR'] = value

# Fill any NA values with the best forward or backarwd value

market.fillna(method='ffill', inplace=True)

del cc, original_value, value, index

[*********************100%***********************] 1 of 1 completed

# Clean up dataframes and keep only EUR with the symbol name

# Same for Market

for column in stocks.columns:

if ':EUR' not in column:

stocks.drop(column, axis='columns', inplace=True)

symbol, currency = column.split(':')

stocks.rename(mapper={column: symbol}, axis='columns', inplace=True)

for column in market.columns:

if ':EUR' not in column:

market.drop(column, axis='columns', inplace=True)

symbol, currency = column.split(':')

market.rename(mapper={column: symbol}, axis='columns', inplace=True)

del column, symbol, currency

# Create a checkpoint

stocks.to_csv('cache_stocks.csv')

market.to_csv('cache_market.csv')

# Restore Checkpoint

stocks = pd.read_csv('cache_stocks.csv')

stocks.set_index(pd.DatetimeIndex(stocks['Date']), inplace=True)

stocks.drop(['Date'], axis='columns', inplace=True)

market = pd.read_csv('cache_market.csv')

market.set_index(pd.DatetimeIndex(market['Date']), inplace=True)

market.drop(['Date'], axis='columns', inplace=True)

# Construct the dictionary with your views

views = stocks_pd['Prediction'].to_dict()

# Construct a uncertanties dictionary

optimistic = stocks_pd['Optimistic'].to_dict()

pesimistic = stocks_pd['Pesimistic'].to_dict()

variances = []

for symbol in views.keys():

sigma = (optimistic[symbol] - pesimistic[symbol])/2

variances.append(sigma ** 2)

omega = np.diag(variances)

del optimistic, pesimistic, variances, symbol, sigma

# Construct the Black Litterman

S = risk_models.CovarianceShrinkage(stocks).ledoit_wolf()

delta = black_litterman.market_implied_risk_aversion(market['Market Ref'])

# Using a pi equal weighted as the market caps for stocks are too complex to calculate

bl = BlackLittermanModel(S, pi="market", market_caps=stocks_pd['Market Cap'],

risk_aversion=delta, absolute_views=views, omega=omega)

ret_bl = bl.bl_returns()

S_bl = bl.bl_cov()

from pypfopt import EfficientFrontier, objective_functions

ef = EfficientFrontier(ret_bl, S_bl)

ef.add_objective(objective_functions.L2_reg)

ef.max_sharpe()

weights = ef.clean_weights()

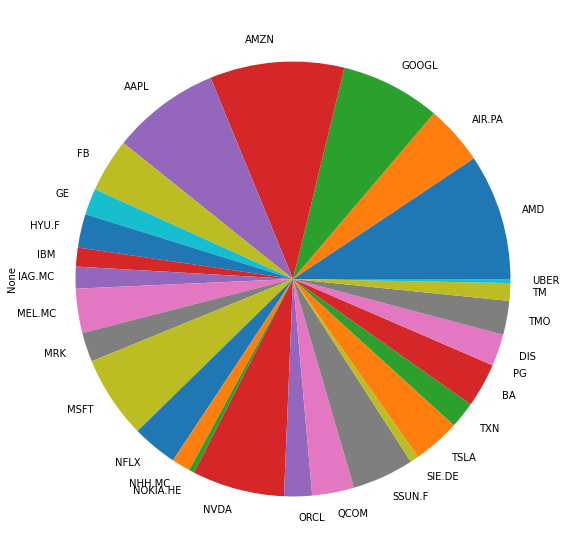

pd.Series(weights).plot.pie(figsize=(10,10));

/home/luis/.local/lib/python3.8/site-packages/pypfopt/efficient_frontier.py:195: UserWarning: max_sharpe transforms the optimisation problem so additional objectives may not work as expected.

warnings.warn(

/home/luis/.local/lib/python3.8/site-packages/pandas/plotting/_matplotlib/core.py:1547: MatplotlibDeprecationWarning: normalize=None does not normalize if the sum is less than 1 but this behavior is deprecated since 3.3 until two minor releases later. After the deprecation period the default value will be normalize=True. To prevent normalization pass normalize=False

results = ax.pie(y, labels=blabels, **kwds)

from pypfopt import DiscreteAllocation

da = DiscreteAllocation(weights, stocks.iloc[-1], total_portfolio_value=TOTAL_FUNDS)

alloc, leftover = da.greedy_portfolio()

allocation = pd.DataFrame(data=stocks_pd['Company Name'],

index=stocks_pd.index, columns=['Company Name'])

for key in alloc.keys():

allocation.at[key, 'Desired Position'] = alloc[key]

allocation.at[key, 'Last Price EUR'] = int(stocks.iloc[-1][key] * 100)/100

allocation.at[key, 'Total Funds EUR'] = int(stocks.iloc[-1][key] * alloc[key] * 100)/100

allocation.fillna(0, inplace=True)

allocation['Desired Position'] = allocation['Desired Position'].astype(int)

allocation

| Company Name | Desired Position | Last Price EUR | Total Funds EUR | |

|---|---|---|---|---|

| Symbol | ||||

| AMD | Advanced Micro Devices, Inc. | 46 | 81.66 | 3756.74 |

| AIR.PA | Airbus SE | 19 | 89.62 | 1702.78 |

| GOOGL | Alphabet Inc. | 2 | 1522.77 | 3045.55 |

| AMZN | Amazon.com, Inc. | 2 | 2713.83 | 5427.66 |

| AAPL | Apple Inc. | 28 | 112.19 | 3141.34 |

| BA.L | BAE Systems plc | 0 | 0.00 | 0.00 |

| CSCO | Cisco Systems, Inc. | 0 | 0.00 | 0.00 |

| BN.PA | Danone S.A. | 0 | 0.00 | 0.00 |

| FB | Facebook, Inc. | 7 | 230.63 | 1614.46 |

| GE | General Electric Company | 80 | 9.66 | 773.20 |

| HYU.F | Hyundai Corporation | 29 | 34.29 | 994.69 |

| IDR.MC | Indra Sistemas, S.A. | 0 | 0.00 | 0.00 |

| INTC | Intel Corporation | 0 | 0.00 | 0.00 |

| IBM | International Business Machines Corporation | 5 | 109.24 | 546.21 |

| IAG.MC | International Consolidated Airlines Group, S.A. | 374 | 1.73 | 649.82 |

| PHIA.AS | Koninklijke Philips N.V. | 0 | 0.00 | 0.00 |

| MEL.MC | Meliá Hotels International, S.A. | 237 | 5.53 | 1311.79 |

| MRK | Merck & Co., Inc. | 12 | 71.47 | 857.75 |

| MSFT | Microsoft Corporation | 13 | 186.91 | 2429.83 |

| NESN.SW | Nestlé S.A. | 0 | 0.00 | 0.00 |

| NFLX | Netflix, Inc. | 3 | 436.74 | 1310.22 |

| NHH.MC | NH Hotel Group, S.A. | 159 | 3.46 | 550.14 |

| NOKIA.HE | Nokia Corporation | 48 | 3.23 | 155.20 |

| NVDA | NVIDIA Corporation | 5 | 457.92 | 2289.63 |

| ORCL | Oracle Corporation | 15 | 54.12 | 811.92 |

| PEP | PepsiCo, Inc. | 0 | 0.00 | 0.00 |

| QCOM | QUALCOMM Incorporated | 9 | 132.99 | 1196.92 |

| SSUN.F | Samsung Electronics Co., Ltd. | 1 | 1382.00 | 1382.00 |

| SIE.DE | Siemens Aktiengesellschaft | 2 | 124.30 | 248.60 |

| ENR.DE | Siemens Energy AG | 0 | 0.00 | 0.00 |

| SPOT | Spotify Technology S.A. | 0 | 0.00 | 0.00 |

| TSLA | Tesla, Inc. | 2 | 700.34 | 1400.68 |

| TXN | Texas Instruments Incorporated | 5 | 143.26 | 716.30 |

| BA | The Boeing Company | 7 | 182.55 | 1277.86 |

| KHC | The Kraft Heinz Company | 0 | 0.00 | 0.00 |

| PG | The Procter & Gamble Company | 0 | 0.00 | 0.00 |

| DIS | The Walt Disney Company | 6 | 153.26 | 919.56 |

| TMO | Thermo Fisher Scientific Inc. | 2 | 429.14 | 858.29 |

| TM | Toyota Motor Corporation | 4 | 131.02 | 524.09 |

| UBER | Uber Technologies, Inc. | 2 | 48.17 | 96.34 |

| UL | Unilever PLC | 0 | 0.00 | 0.00 |

allocation.to_excel('/mnt/wd-bigfoot/share/luis/OneDrive/Documents/Portfolio/99 Last Allocation of Stocks.xlsx',

index=True)